Reimagining philanthropy and investments: a learning journey with Justice Funders

Jonathan Levy reflects on the first session of JRF's learning journey - exploring community and ecological wealth building in the solidarity economy. Curated by the brilliant Caroline Woolard, and working alongside a group of funders and organisations, it's the start of a two-year strand of work focussed on re-imagining philanthropy, investment, and funding.

In the first session of the Learning Journey, we heard from abdiel j. lópez and Lora Smith of Justice Funders, a US organisation reimagining philanthropic practises through the lens of the Just Transition framework developed by Movement Generation and the Climate Justice Alliance in 2017.

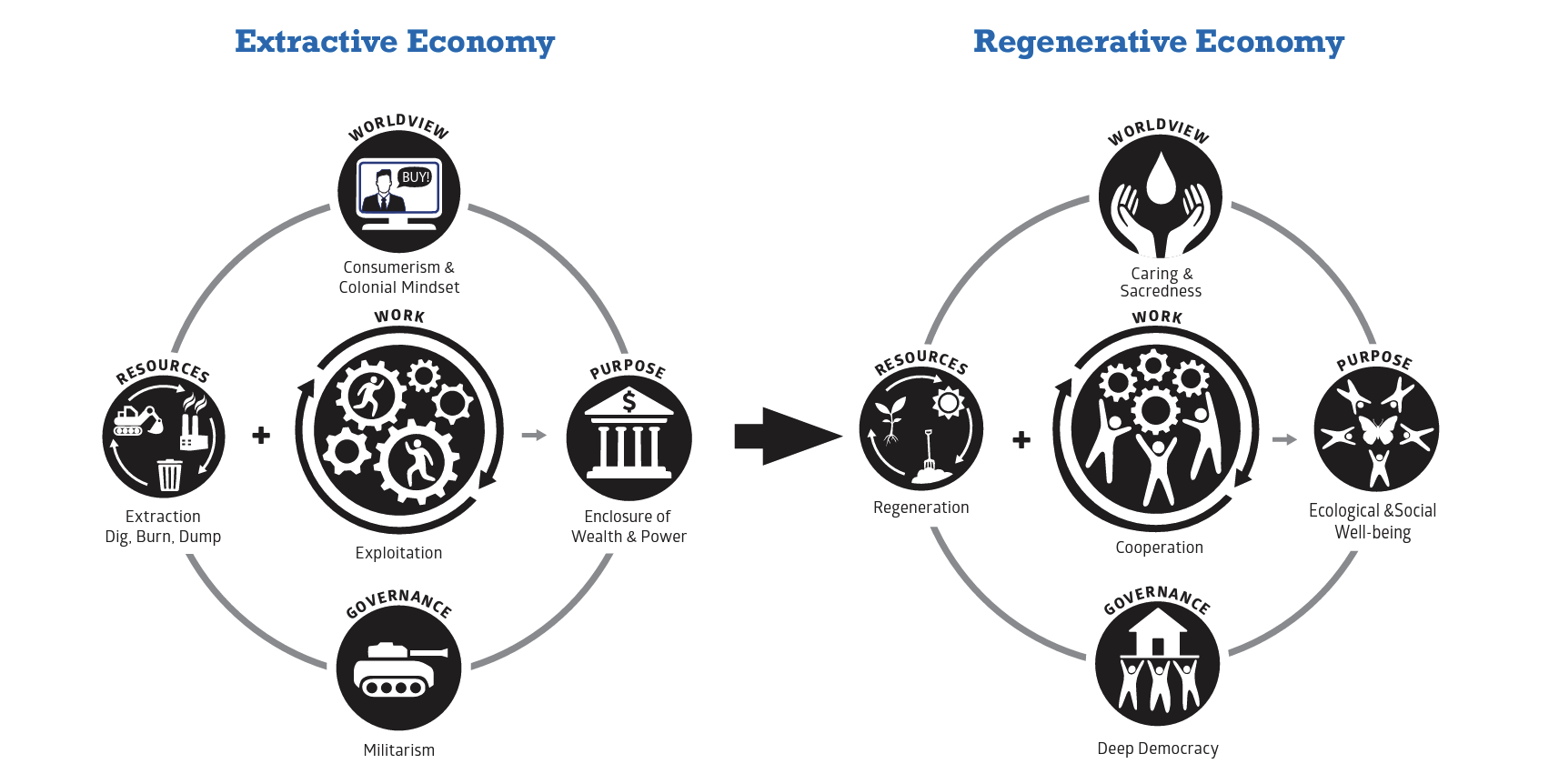

A Just Transition framework: moving from an extractive to a regenerative economy

The Just Transition framework, shown below, has at its core a principle of deep democracy, whereby workers and communities have control over decisions that impact their lives. Alongside the principles of shifting economic control to communities and democratising wealth and the workplace, according to the framework, a Just Transition from an extractive economy to a regenerative economy must drive racial justice and social equity, advance ecological restoration, relocalise most production and consumption, and retain and restore cultures and traditions.

A Just Transition Investment Framework for philanthropy

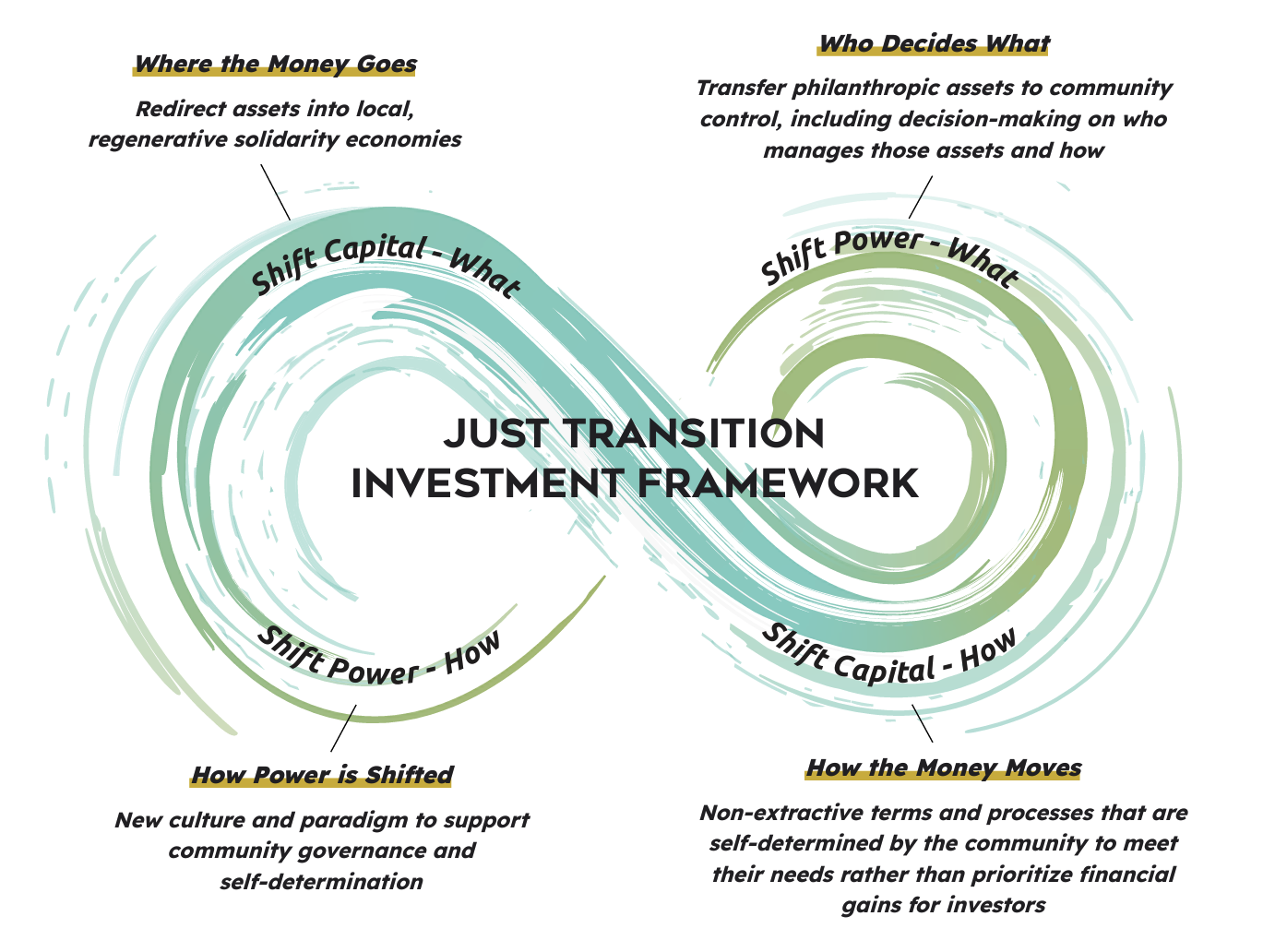

Consistent with the framework, Justice Funders advocates for institutional philanthropy to redistribute wealth, democratise power, and shift economic control to communities. To this end, in February 2023, Justice Funders launched its Just Transition Investment Framework, articulating why and how philanthropic institutions should redirect their wealth from the dominant financial system to community-controlled initiatives that build economic power and self-determination. This recognises that grants alone are insufficient to resource movements for systemic economic transformation.

As shown below, the Just Transition Investment Framework requires philanthropic wealth to be redirected into local solidarity economies through terms and processes that are self-determined by communities to meet their needs. This transfer of assets, along with decision-making power over who manages these assets and how, needs to be facilitated by a new culture and paradigm in philanthropy that supports community governance and self-determination.

We learnt from abdiel and Lora in the session how Justice Funders has seeded and grown a Just Transition Investment Community, presently comprising 14 US philanthropic institutions, to learn from one another and take action consistent with the values and principles of the Just Transition Investment Framework.

An exciting next step will be the launch of a capital fund, governed by movement leaders, that will pool philanthropic grant and investment capital to deploy non-extractive, five- to ten-year (or longer) loan and grant finance to movement-owned Just Transition projects and loan funds.

A reimagining of how philanthropic wealth is held and invested

The work of Justice Funders has prompted us to further examine our beliefs and practises around how philanthropic wealth is and ought to be managed and controlled. We need to think deeply about our current investment strategies, especially the vast degree to which philanthropic wealth is invested in the dominant financial system to maintain its value and maximise returns. And we need to address how we can work together to shift institutional cultures to transfer wealth and economic power.

For the JRF Emerging Futures team we’re especially interested in how we can direct philanthropic wealth into work that is proposing and building the alternatives we need – like the 23 Pathfinders we recently invested in. All of these initiatives are doing work that is related to ecological and community wealth building, fostering self-determination in communities and creating infrastructures in support of that to reduce reliance on philanthropy over the long-term.

In the group discussion that followed the session with Justice Funders, it was acknowledged that a precursor to developing a culture shift towards solidarity economy principles among philanthropic institutions is an understanding of racial justice and the history of extraction from racialised communities. Participants also spoke about the existing impact investment and social investment ecosystem in the UK, and whether a full-scale reimagining of these systems is required to apply the Just Transition Investment Framework in a UK context.

With respect to devolving decision-making power over how resources are allocated, important questions were raised by participants in the group on what capacity building is required to do this in a responsible way alongside the innovation of new mechanisms to redistribute wealth. For example, Justice Funders has chosen to work with movements that already have a lending arm to their work so there is already a degree of expertise and understanding around this type of finance. Communities are likely to have distinct requirements to collectively govern wealth in ways that meet their needs, and it may be that providing core operational funding or technical support is necessary for community members to develop this approach.

Next steps on the journey

At the end of this month, in the next instalment of this Learning Journey, we look forward to hearing from the Boston Ujima Project and Seed Commons. This will further develop our thinking on ways in which we might be able to collectively help grow the Solidarity Economy in the UK, with practises and initiatives that ensure wealth, resources, and other assets flow though regenerative, reparative, and distributive economic principles.

Join our Next Frontiers conference

These themes of funding, philanthropy and investment will be explored further at our conference, Next Frontiers, which will be taking place on Tuesday 11 July. You can learn more about the event, and register for it here.

This reflection is part of the wealth, funding and investment practice topic.

Find out more about our work in this area.